COMPARE INVESTOR PLANS

Choose the plan that matches your investing stage and capital.

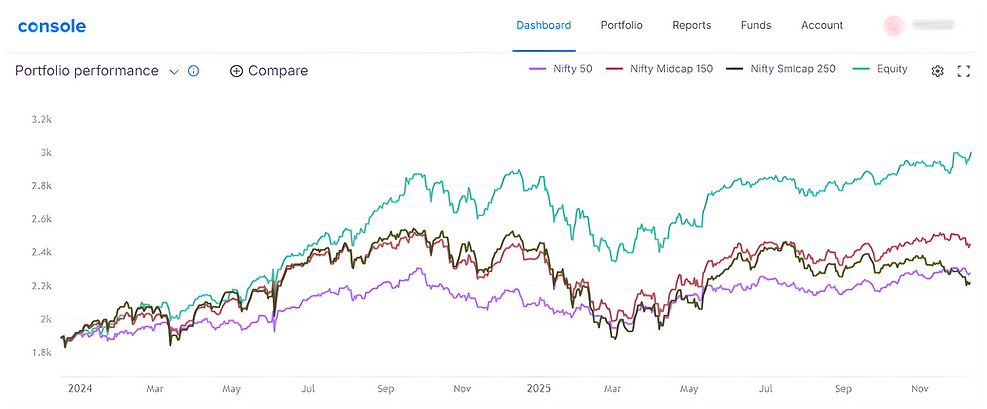

This chart (as of 21st Dec 2025) shows my real equity portfolio compared with Nifty 50, Nifty Midcap 150, and Nifty Smallcap 250.

It is real, tracked data — not a demo or backtest.

All plans follow one core approach:

✔ Quality stocks

✔ Risk control

✔ Long-term discipline

The plan may change. The process does not.

Choose the plan that fits your level. The discipline stays constant.

Based on Real Equity Performance

.png)

✔

Every investor is different.

✔

Some want faster growth.

✔

Some are just starting.

✔

Some want personalised management.

Here is a simple comparison to help you choose the right plan.

All plans are focused on long-term wealth creation, No intraday or derivatives.

How To Choose The Right Plan

Premium Membership (Beginner Investor)

Choose this if:

✔ You are new to investing

✔ You want guidance and learning

✔ You are starting with smaller capital

✔ You prefer step-by-step investing

Super Premium Membership (Advanced Investor)

Choose this if:

✔ You already invest regularly

✔ You want faster growth

✔ You are comfortable with higher capital

✔ You want global exposure

Portfolio Management Service (Professional Investor)

Choose this if:

✔ You have capital above ₹25 Lakhs

✔ You want personalised portfolio management

✔ You prefer long-term discipline

✔ You want performance-linked fees

UNDERSTANDING RISK

Equity and other asset markets can fluctuate. Temporary losses are possible during adverse market phases. Returns are not guaranteed. However, all decisions are taken with research, experience, and risk control.