PORTFOLIO MANAGEMENT SERVICE (PMS)

Your Wealth. Managed with Discipline and Care

This chart (as of 21st Dec 2025) shows my real equity portfolio compared with Nifty 50, Nifty Midcap 150, and Nifty Smallcap 250.

It is real, tracked data — not a demo or backtest.

The PMS follows the same disciplined approach:

✔ Quality businesses

✔ Risk-aware position sizing

✔ Long-term investing

Designed for steady wealth building over time.

PMS Built on Real Portfolio Experience

.png)

I’m Rajasekar,

With over 10 years of real stock market experience, I help investors grow wealth in a calm, structured, and disciplined way.

This PMS is designed for investors who want long-term wealth creation with clarity, risk awareness, and peace of mind.

_edited.png)

Welcome aboard!

We're excited to help you manage your investments and potentially grow your wealth.

WHO THIS PMS IS FOR

This PMS is suitable for you if:

✔ You want long-term wealth through investing

✔ You prefer quality businesses over frequent trading

✔ You can stay invested for 3 years or more

✔ You value process and discipline

This PMS is NOT suitable for you if:

✔ You expect guaranteed returns

✔ You look for quick or short-term profits

✔ You are uncomfortable with market ups and downs

OUR INVESTMENT PHILOSOPHY

✔ Indian equity investing is the core focus

✔ Capital protection is always a priority

✔ Fewer stocks, higher conviction

✔ Decisions are process-driven, not emotional

✔ Diversification is used only to manage risk

We focus on consistency, not speculation.

"Process protects capital. Discipline grows it."

HOW WE BUILD YOUR PORTFOLIO

Step 1: Core Equity Portfolio (Primary Focus)

Indian equities form the main part of the portfolio.

Stocks are selected using deep fundamental and technical analysis, focusing on business quality, financial strength, and long-term growth.

Step 2: Optional Global Equity Exposure

Based on the client’s preference, selective US stocks may be added to gain exposure to strong global companies and different economic cycles.

Step 3: Optional Precious Metals Allocation

If the client wishes, gold and silver can be included as stability assets to help manage risk during market stress or inflationary phases.

Step 4: Optional Digital Asset Exposure

A small and controlled exposure to cryptocurrencies is considered only if the client specifically opts for it and understands the risks. This is used strictly for long-term diversification.

This PMS is suitable for investors who want equity as the core, along with measured exposure to global assets like US stocks, gold, silver, and select digital assets for diversification.

PORTFOLIO MANAGEMENT STYLE

✔ Equity-led investing with global diversification

✔ No intraday, derivatives, short-term trading or speculation

✔ Allocation decided based on market conditions and risk profile

✔ Portfolio reviewed periodically to maintain balance

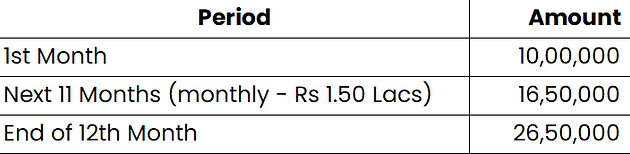

Capital Requirements:

STOCK SELECTION PROCESS (EQUITY)

✔ Universe starts with around 5,600 listed companies

✔ Shortlisted to 190–200 companies using filters like ROCE, cash flows, debt levels, and business quality

✔ Deep research on growth, valuation, and industry risks

✔ Final portfolio of 20–25 carefully selected stocks

This focused approach helps manage risk and conviction better.

5,600 Stocks

190-200 Stocks

20-25 Stocks

BSE & NSE - 5,600 listed companies

Qualitative filters: Apply Filters (e.g., High ROCE, Positive Operating cashflows, Low net debt to equity

Research for Growth Prospects, Management Quality, Price Filters, Industry Exposure

WHY INVEST WITH FUNTECH PMS

✔ 10+ years of real market experience

✔ Clear and transparent process

✔ Focused portfolios

✔ Performance-linked fees

✔ Personal attention, limited clients

✔ Calm and disciplined investing approach

Investment Growth:

-

Our goal is to grow your investment gradually over the years, aiming for significant returns (potentially 100%) by 4th year.

Please note: The first year will focus on buying and won't generate immediate gains. -

All buying and selling decisions will be based on our thorough technical and fundamental analysis.

Fee Structure:

Our fees are based on your investment amount:

-

Below ₹25 Lakhs: Refer our Super Premium Membership

-

₹25 Lakhs to ₹50 Lakhs: 10% on realized capital gains and Dividends

-

₹50 Lakhs to ₹75 Lakhs : 9% on realized capital gains and Dividends

-

Above ₹75 Lakhs: 8% on realized capital gains and Dividends

Exit Fees:

To achieve the best results, we recommend a commitment of at least 3 years. This allows us to implement a long-term investment strategy with the potential for higher returns.

If you choose to terminate the service before 3 years, an exit fee will apply:

-

Year 1 : 0.50% of your total investment

-

Year 2: 0.40% of your total investment

-

Year 3: 0.30% of your total investment

Understanding Risk:

Equity investments are impacted by market movements and carry inherent risk. This means your investment value could go down during unforeseen events.

FunTech cannot guarantee specific returns or protect your investments against losses. However, we will use our best expertise and research to manage your portfolio effectively.

Thank you for your trust in FunTech. We look forward to managing your portfolio and helping you achieve your financial goals.

We do not chase trends. We build balanced portfolios that can sustain across market cycles.

You cannot make money or become wealthy.

Unless you either learn how to do it properly or hire someone who already knows.

If you refuse to learn or take expert help, real wealth will never come.

Frequently Asked Questions